The question dominating crypto desks this week is whether the cycle is intact, and when the bull run will return. Two widely followed macro commentators sketched the same causal chain from public-sector cash management to crypto asset beta, arguing that the current drawdown is a liquidity story first and a sentiment story second—and that its reversal hinges on the mechanics of the US Treasury General Account (TGA), Federal Reserve balance-sheet policy, and the timing of Washington’s reopening.

Crypto Market Awaits US Government Shutdown Resolution

Macro analyst @plur_daddy on X summarizes the current state bluntly: “We are seeing the contraction in liquidity flowing through into risk markets. Naturally it first showed up in BTC and market internals within equities, and now is finally hitting the broader indices.” He describes a textbook quality rotation underway—speculative thematics “such as quantum, nuclear, drones, and alt energy have been getting destroyed,” while flows consolidate into the megacap cohort and earnings-backed momentum, notably the AI capex complex.

The underlying plumbing, in his reading, is starved of bank reserves as cash piles into the TGA and quantitative tightening (QT) continues to shrink the Fed’s balance sheet. “Monetary liquidity is drawing down as the TGA has become overfilled beyond the Treasury Dept’s $850bn cap, due to mechanical factors around higher issuance, timing of specific payments, and the government shutdown. There is a broader lack of bank reserves which continues to fall below the key $3trn threshold.” His conclusion is conditional but clear: these stresses “will precipitate actions to calm market plumbing but it will take time.”

Related Reading

On the dollar and cross-asset risk, he points to a crucial level: “The DXY has been rallying and is now approaching a key level at 101, which would be a logical point for it to top. I continue to believe the Trump administration wants a lower dollar.” The path to a crypto bottom, in his cadence, is explicitly tied to policy milestones: “The government reopening provides a clear catalyst to mark the bottom in liquidity conditions. Then, we get QT unwinding Dec 1 and then potentially more Fed actions (such as hints on bills repurchases) on Dec 10. The fiscal deficit will expand significantly starting Jan 1 as the OBBBA will fully kick in.”

He characterizes Bitcoin’s behavior as resilient—“BTC has held in well despite tremendous OG selling, the aftermath of 10/10, and the factors above”—and describes his own playbook accordingly: “I currently have a sizable cash position and plan to aggressively add equities (especially the memory trade) and BTC once the government reopening looks imminent.” Hours later he added, “Bought some BTC. Seeing progress being made towards government reopening and signs that liquidity headwinds have peaked. Risk/reward here is strong with sentiment bombed out.”

When The Liquidity Returns

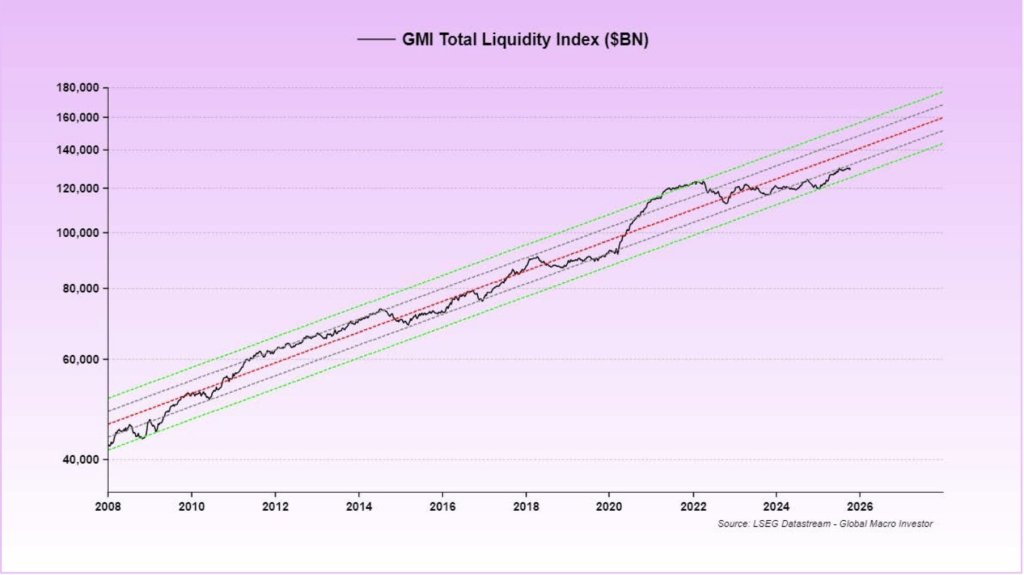

Raoul Pal, whose framework centers almost entirely on the global liquidity cycle, pushes the same thesis to its logical macro conclusion. “If global liquidity is the single most dominant macro factor then we MUST focus on that,” he writes, before distilling the next year of market structure into a single constraint: “REMEMBER — THE ONLY GAME IN TOWN IS ROLLING $10TRN IN DEBT. EVERYTHING ELSE IS A SIDESHOW. THIS IS THE GAME OF THE NEXT 12 MONTHS.”

In Pal’s telling, the shutdown’s effect is immediate and mechanical—“the gov shutdown has forced a sharp tightening of liquidity as the TGA builds up with no where to spend it. This is not offset by the ability to drain the Reverse Repo (it is drained). And QT drains it further”—and crypto, as the highest-beta liquidity asset, takes the brunt.

The pivot, he argues, is likewise mechanical once fiscal operations restart: “As soon as the gov shutdown ends, the Treasury begins spending $250bn to $350bn in a couple of months. QT ends and the balance sheet technically expands. The Dollar will likely begin to weaken again as liquidity begins to flow.”

Related Reading

He layers on prospective policy and regulatory catalysts—“SLR changes free up more of the banks balance sheets allowing for credit expansion. The CLARITY Act will get passed, giving the crypto regs so desperately needed for large scale adoption by banks, asset managers and businesses overall. The Big Beautiful Bill then kicks in to goose the economy into the midterms”—and frames the global backdrop as additive, with China’s balance-sheet expansion and Japan’s policy mix supporting a broader risk rally.

His tactical advice is to accept bull-market volatility without over-reacting: “Always remember the Dont Fuck This Up rules… and wait out the volatility. Drawdowns like this are common place in bull markets and their job is to test your faith. BTFD if you can.” The punchline comes down to a single indicator within his dashboard: “td:dr — When this number goes up, all numbers go up.”

The through-line across both perspectives is the primacy of dollar liquidity—specifically, the interaction of Treasury cash balances, Fed asset purchases or run-off, and the available stock of bank reserves after the Reverse Repo Program has largely normalized. When the TGA rises without offset, it functions as a suction pump on aggregate reserves; when it falls as the Treasury spends, reserves rebuild, the marginal cost of leverage eases, and high-beta assets—crypto first—tend to outperform.

Where does that leave the timing question implied by every red candle on crypto Twitter? Neither source offers a date, but both tether the next leg higher to the same sequence: a resolution in Washington that flips the TGA from hoarding to spending, visible easing in reserve scarcity as QT pauses or is unwound, a swerve lower in the dollar from resistance, and renewed fiscal impulse that re-steepens the growth impulse into 2026.

At press time, the total crypto market cap stood at $3.38 trillion.

Featured image created with DALL.E, chart from TradingView.com