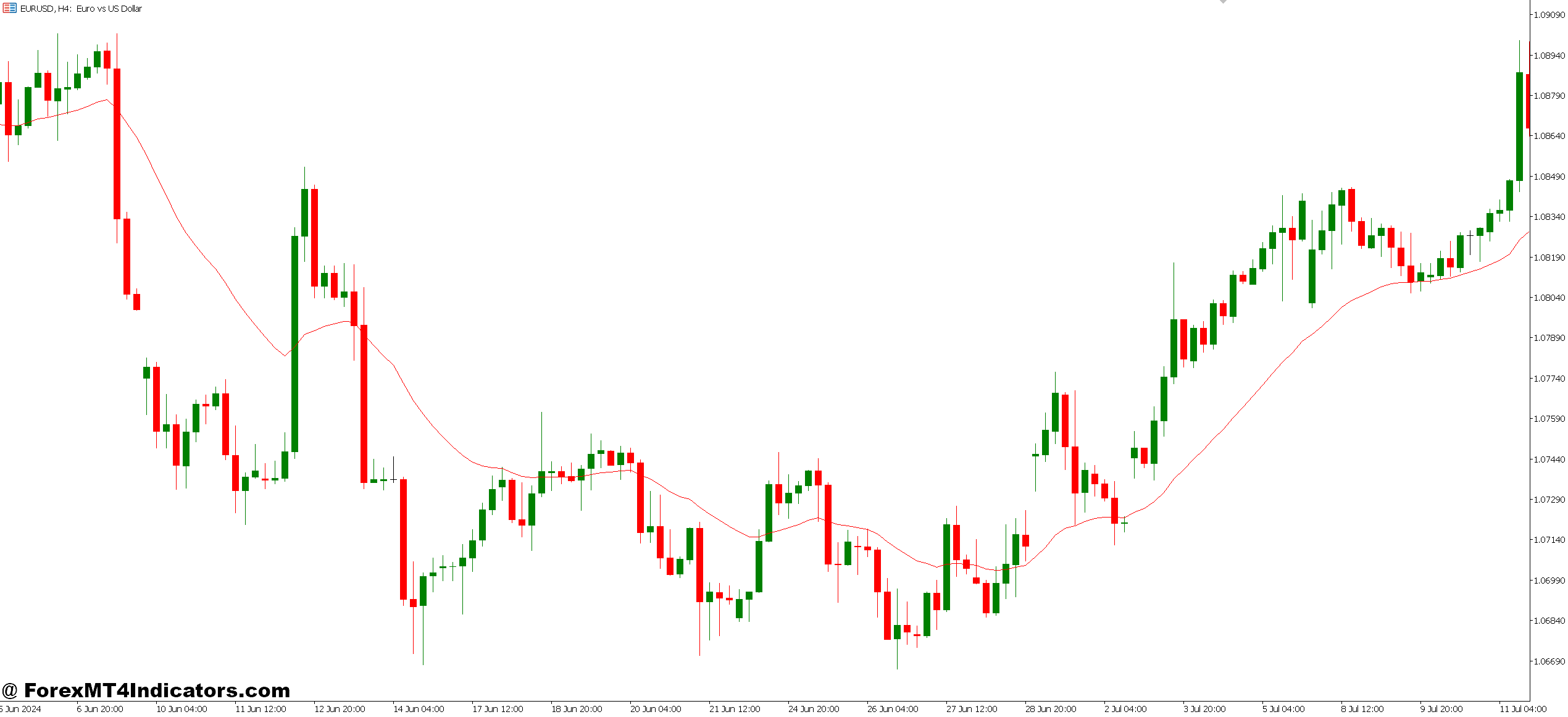

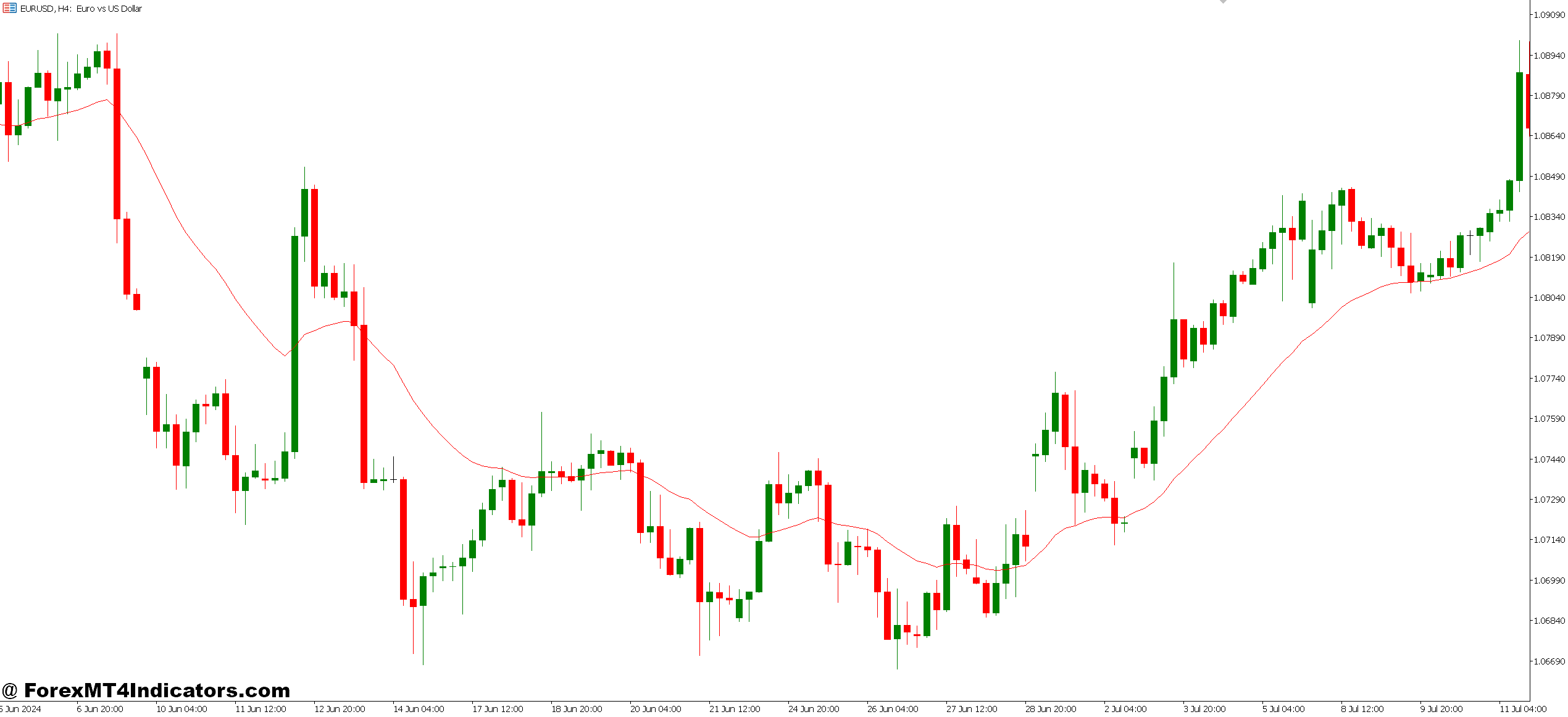

The Moving Average in MetaTrader 5 calculates the mean price over a specified period, then plots it as a line on the chart. But MT5 takes this basic concept further by offering four distinct calculation methods: Simple (SMA), Exponential (EMA), Smoothed (SMMA), and Linear Weighted (LWMA).

Each method treats price data differently. The SMA gives equal weight to all periods—a 20-period SMA on EUR/USD averages the last 20 closes with no bias. The EMA, by contrast, prioritizes recent prices using an exponential weighting factor. Traders testing this on the 4-hour GBP/JPY chart quickly notice the EMA hugs price action tighter than its simple counterpart.

The SMMA adds another layer of smoothing, essentially creating a moving average of a moving average. It reacts slower than the EMA but filters out more noise. The LWMA falls somewhere between, assigning linearly decreasing weights to older prices.

How MT5 Calculates the Moving Average

Here’s where things get technical. The Simple Moving Average uses this formula: SMA = (P1 + P2 + … + Pn) / n, where P represents price and n equals the period length. That’s straightforward math—add up the closes and divide by the number of periods.

The Exponential Moving Average gets trickier. It uses: EMA = (Close – Previous EMA) × Multiplier + Previous EMA. The multiplier equals 2 / (n + 1), giving more weight to recent data. A 12-period EMA on USD/CAD reacts roughly twice as fast as a 26-period version when price shifts direction.

The Smoothed Moving Average calculation involves: SMMA = (Previous SMMA × (n – 1) + Close) / n. This creates the slowest-moving line of the bunch, which some swing traders prefer for filtering intraday noise on daily charts.

MT5 handles these calculations automatically, but understanding the math helps traders grasp why a 50-period EMA responds differently than a 50-period SMA during volatile NFP announcements. The EMA drops faster when bad news hits, while the SMA takes its sweet time adjusting.

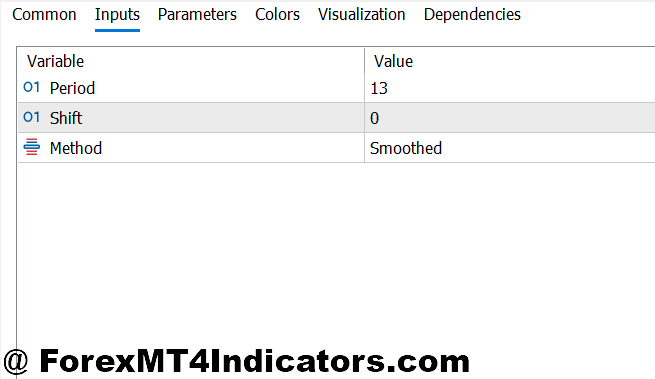

Real-World Application and Settings

Most traders start with the classic 50 and 200-period combo on daily charts. When the 50 crosses above the 200 on AUD/USD, that’s historically signaled stronger uptrends. But here’s the thing—these “golden cross” setups work better on trending pairs like GBP/NZD than range-bound ones like EUR/CHF.

For day trading, the settings need adjustment. A scalper working the 5-minute EUR/USD chart might use a 9-period EMA for quick entries, watching how price bounces off the line during London session trends. The faster period catches moves earlier but generates more false signals when the market chops sideways during lunch hours.

Swing traders often prefer the 20 and 50-period EMAs on 4-hour charts. When USD/JPY holds above both moving averages, the bias stays bullish until price closes below the 20 EMA. That said, traders should test different periods because the “right” setting depends on the pair’s average true range and trading session.

The applied price setting matters too. MT5 lets traders calculate based on close, open, high, low, or median prices. Most stick with close prices for end-of-period confirmation, but some commodity currency traders use median prices to reduce spike impact on AUD/USD during Reserve Bank announcements.

Advantages and Honest Limitations

The MT5 Moving Average excels at identifying trend direction without cluttering charts. Unlike oscillators that bounce between fixed levels, this indicator adapts to any price range. A trader glancing at NZD/USD knows instantly whether the market’s trending when price consistently stays above the 200 EMA.

The multiple calculation methods offer real flexibility. During high-volatility Brexit votes, switching from SMA to EMA helped GBP pairs traders react faster to genuine breakouts versus fakeouts. The indicator also doubles as dynamic support and resistance—price often bounces off the 50-period MA during strong trends.

But no tool’s perfect. Moving averages lag by design since they use historical data. That 200-period SMA on USD/CHF reflects where price was, not where it’s going. By the time the moving average confirms a trend reversal, sharp traders already caught the early move using price action.

Choppy markets murder moving average strategies. When EUR/GBP trades sideways for weeks, the crossover signals flip-flop constantly. Traders who followed every 20/50 EMA cross during August range-trading lost money on whipsaws. The indicator can’t distinguish between a pullback and a reversal until after the fact.

Another limitation: moving averages offer zero predictive value about magnitude. They’ll signal an uptrend started, but won’t tell if that move will gain 50 pips or 500 pips. Trading forex carries substantial risk. No indicator guarantees profits, and past trend identification doesn’t predict future price movement.

How It Compares to Other Moving Averages

MT5’s version stands out from competitors mainly through customization. Other platforms might limit traders to SMA and EMA, but MT5 includes SMMA and LWMA out of the box. TradingView offers similar variety, though MT5’s LWMA calculation runs slightly different due to platform-specific implementations.

Against Bollinger Bands—which incorporate moving averages plus standard deviations—the basic MA feels stripped down. Bollinger Bands show both trend direction and volatility, while the MA only handles trend. But that simplicity helps beginners avoid information overload. A clean 50 EMA on CAD/JPY beats a cluttered chart with six indicators any day.

Compared to MACD, which uses moving average convergence-divergence, the basic MA lacks momentum confirmation. MACD catches early trend changes through histogram crosses, whereas the MA waits for price to actually cross the line. Some traders run both: the 200 EMA for overall bias, MACD for entry timing on GBP/AUD.

The Ichimoku Cloud uses multiple moving averages plus shifted lines, creating a more complete picture. But the MT5 Moving Average wins on speed—it loads faster, calculates quicker, and doesn’t bog down when testing strategies across multiple pairs and timeframes.

How to Trade with MT5 Moving Average Indicator

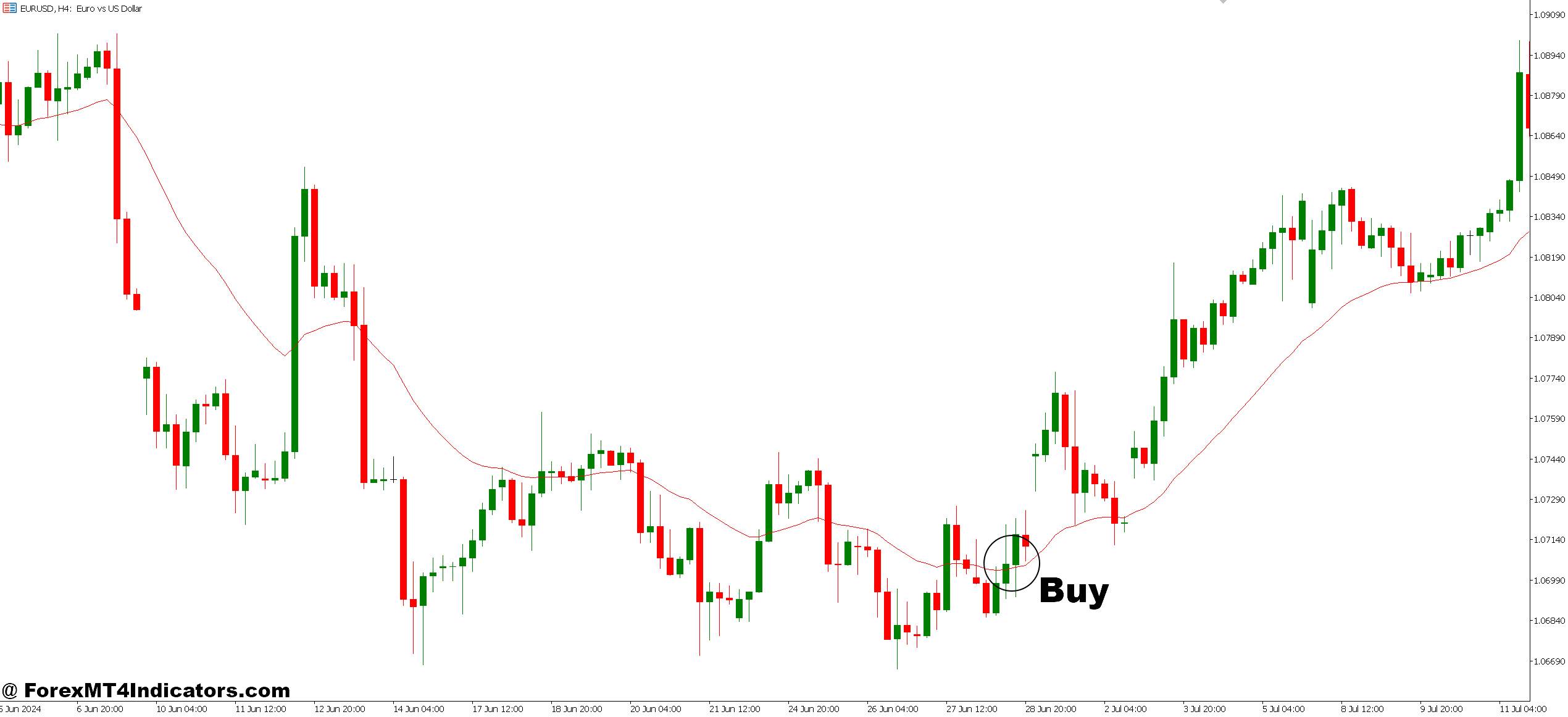

Buy Entry

- Price closes above 50 EMA – Wait for a full candle close above the 50-period EMA on the 4-hour EUR/USD chart; don’t enter on wicks or during the candle formation.

- Bullish MA crossover confirmed – Enter when the 20 EMA crosses above the 50 EMA on GBP/USD daily charts, but skip this signal if it happens within 30 pips of major resistance.

- Bounce off MA during uptrend – Buy when price pulls back to touch the 20 EMA and bounces on the 1-hour chart, confirming with a bullish engulfing candle.

- Multiple MAs aligned bullishly – Take long positions when price sits above 20, 50, and 200 EMAs simultaneously on 4-hour timeframes, signaling strong trend momentum.

- Risk 1-2% per trade – Set stop loss 10-15 pips below the moving average that triggered entry; never risk more than 2% of account balance regardless of setup quality.

- Avoid during major news – Skip MA signals 30 minutes before and after high-impact NFP or central bank announcements when whipsaws increase 300%.

- Volume confirmation preferred – Look for above-average volume on the crossover candle; weak volume on EUR/GBP often leads to false breakouts within 20 pips.

- Don’t chase extended moves – Skip entry if price already sits 100+ pips above the 50 EMA on daily charts; wait for the next pullback instead.

Sell Entry

- Price closes below 50 EMA – Enter short when a full 4-hour candle closes below the 50-period EMA on USD/JPY, ignoring intrabar movements.

- Bearish MA crossover confirmed – Sell when the 20 EMA crosses below the 50 EMA on daily GBP/USD charts, but avoid if price hovers within 25 pips of major support.

- Rejection from MA during downtrend – Short when price rallies to the 20 EMA and gets rejected with a bearish pin bar on 1-hour EUR/USD.

- All MAs pointing down – Take shorts when 20, 50, and 200 EMAs slope downward with price below all three on 4-hour charts.

- Set tight stops on scalps – Use 8-10 pip stops when trading 5-minute chart MA bounces; these fast timeframes require precision exits.

- Skip during ranging markets – Don’t trade MA crossovers when EUR/CHF trades in a 50-pip range for 3+ days; crossovers become meaningless noise.

- Wait for momentum confirmation – Pair MA signals with RSI below 50 on daily charts; crossovers without momentum fade 60% of the time.

- Avoid Fridays after 12 PM EST – MA signals on USD/CAD Friday afternoons produce 40% more false signals as liquidity dries up before the weekend.

Putting It All Together

The MT5 Moving Average indicator delivers trend clarity through flexible calculation methods that traders can tune to their strategy. The four calculation types—Simple, Exponential, Smoothed, and Linear Weighted—each serve different trading styles, from scalping 1-minute charts to swing trading daily timeframes. Real-world application shows the 50 and 200-period settings work well for position traders, while shorter periods like 9 or 20 suit active day traders on faster charts.

That said, moving averages lag price action by nature and struggle during sideways markets. They confirm trends after they’ve started, not before. Smart traders combine them with support and resistance levels or momentum indicators rather than relying solely on MA signals. Testing various settings on demo accounts helps find what works for specific pairs and timeframes without risking capital.

The tool’s strength lies in simplicity. A single line on the chart beats analysis paralysis from indicator overload. Start with one moving average, learn how it behaves across different market conditions, then add complexity only if needed. Sometimes the basics work best.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 90% VIP Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90