Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Crypto markets edged lower Monday following a stark warning from Goldman Sachs, which raised its 12-month US recession probability to 35%, citing rising tariffs, weakening growth, and deteriorating sentiment. The reassessment follows the firm’s second upward revision in March to its 2025 US tariff expectations, signaling an increasingly fraught macroeconomic environment with direct implications for risk assets — including cryptocurrencies.

In the note titled “US Economics Analyst: A Further Increase in Our Tariff Assumptions”, Goldman economists Alec Phillips, Tim Walker, and David Mericle outline their rationale: “We now expect the average US tariff rate to rise 15pp in 2025 […] almost the entire revision reflects a more aggressive assumption for ‘reciprocal’ tariffs.”

Goldman anticipates that President Trump will announce across-the-board reciprocal tariffs averaging 15% on April 2. Adjusted for product and country exclusions, the effective rise in average tariffs is expected to be around 9 percentage points.

The impact on the macro outlook is stark: Goldman has downgraded its 2025 US GDP growth forecast by 0.5pp to 1.0% (Q4/Q4), lifted its year end core PCE inflation forecast to 3.5% (+0.5pp), and increased its unemployment projection to 4.5% (+0.3pp). These revisions reflect a stagnating growth environment paired with inflationary pressures — a combination that constrains monetary stimulus options.

The bank attributes the rise in recession probability to three key factors: a lower growth baseline; deteriorating household and business confidence; and “statements from White House officials indicating greater willingness to tolerate near-term economic weakness.”

Despite historically poor predictive power from sentiment measures, Goldman writes: “We are less dismissive of the recent decline because economic fundamentals are not as strong as in prior years. Most importantly, real income growth has already slowed sharply and we expect it to average only 1.4% this year.”

Implications For Crypto

While digital assets have long been viewed as uncorrelated to traditional macroeconomic variables, that narrative has evolved. Bitcoin, in particular, has become increasingly responsive to broader macro conditions — particularly liquidity, risk sentiment, and real yields.

Related Reading

As the yield curve inverts once again — a classic recession signal — macro analysts are warning of a unique policy dilemma. As @ecoinometrics noted on X: “The yield curve is inverting again, a traditional recession signal. But unlike past cycles, the Fed is unlikely to rush to QE due to inflation concerns. This creates a double challenge for Bitcoin: potential risk-off pressure without the stimulus relief that typically follows. Bitcoin is very much driven by macro these days. It is behaving like a high-beta play on the NASDAQ 100.”

However, not everyone agrees that a recession poses a net-negative risk for crypto. In a recent interview, Robbie Mitchnick, Global Head of Digital Assets at BlackRock, offered a nuanced view of Bitcoin’s macro sensitivity: “Economic fears. I mean, I don’t know if we have a recession or not, but a recession would be a big catalyst for Bitcoin […] It’s catalyzed by more fiscal spending and debt and deficit accumulation. That happens in a recession. It’s catalyzed by lower interest rates and monetary stimulus. That tends to happen in a recession.”

Mitchnick acknowledges the short-term constraints — the wealth effect, reduced disposable income, and high correlations with equities — but maintains that structurally, Bitcoin benefits from the long-term consequences of recessionary policy responses. “Bitcoin is long liquidity in the system… and to some extent over just fears of general social disorder […] that too, unfortunately, is something that can come up in a recession.”

He adds that current market reactions may not reflect Bitcoin’s true positioning: “The market has almost, it seems, gotten this in some ways not particularly well calibrated… but that’s where the opportunity comes in for education in a market and an asset class that’s still very nascent.”

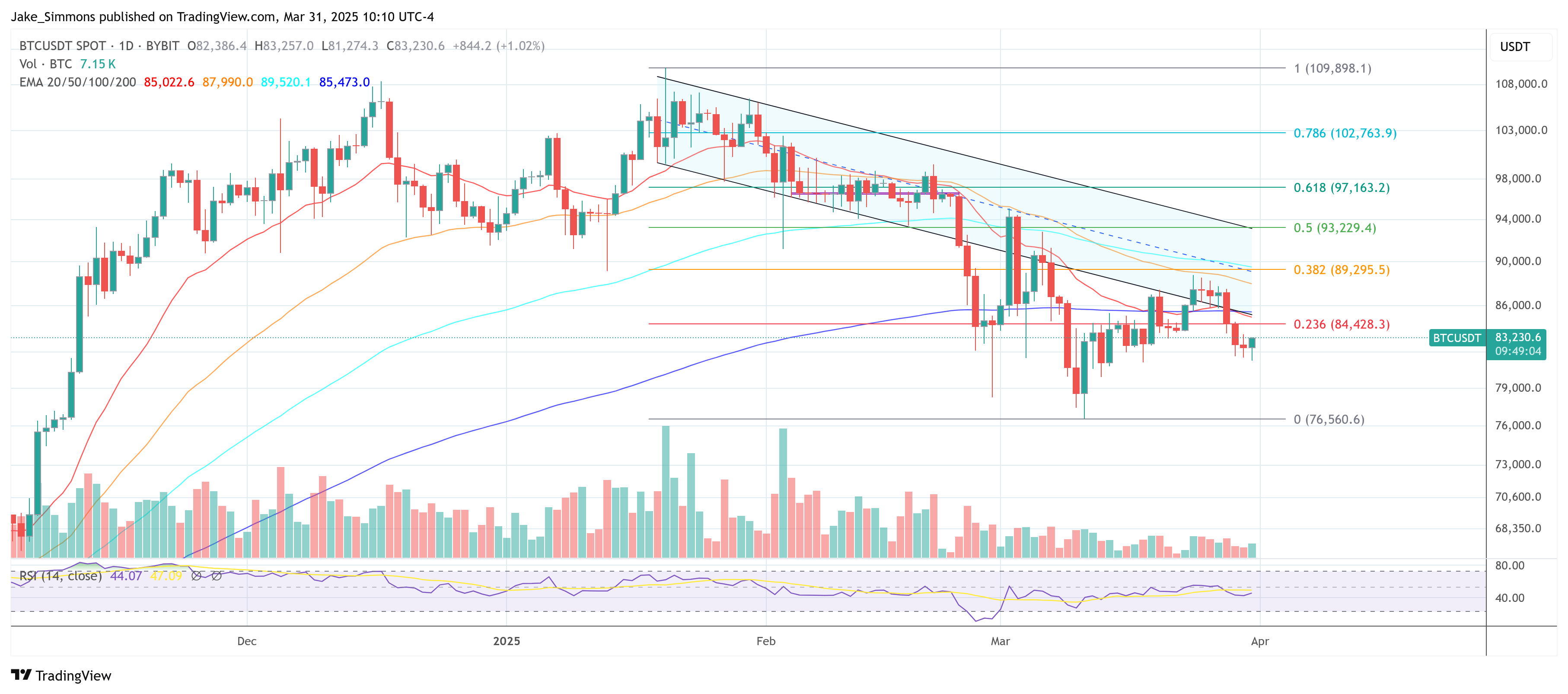

At press time, BTC traded at $83,230.

Featured image from iStock, chart from TradingView.com