Ethereum is trading at a critical juncture after briefly losing the $3,200 level, with bulls struggling to defend it amid rising selling pressure. The broader crypto market remains on edge, as fear and uncertainty continue to weigh on sentiment following days of steady declines across major assets. Traders are watching closely to see if Ethereum can stabilize above this key support zone — a failure to do so could trigger a deeper correction toward the $3,000 area.

Related Reading

Despite the mounting pressure, one prominent Ethereum whale — known for a series of large-scale purchases this month — continues to accumulate aggressively. This investor has consistently added to their position even as the price fell, signaling strong long-term confidence in Ethereum’s fundamentals and recovery potential.

This divergence between short-term fear and long-term accumulation paints a complex picture for Ethereum. While short-term volatility remains a concern, large holders’ continued buying may be setting the foundation for a more sustained rebound once market conditions stabilize and sentiment improves.

Ethereum Whale Keeps Buying Despite Market Turbulence

According to data from Lookonchain, the prominent Ethereum investor known as Whale ’66kETHBorrow’ has continued his large-scale accumulation despite the ongoing market downturn. Earlier today, the whale purchased 19,508 ETH worth approximately $61 million, expanding his already massive position built over the past week.

Shortly after, an update revealed yet another purchase — 16,937 ETH valued at $53.91 million — bringing his total accumulation since November 4 to 422,175 ETH, worth roughly $1.34 billion at an average price near $3,489. Despite the recent price drop, the whale is currently sitting on more than $120 million in unrealized losses, but continues to double down on Ethereum exposure.

This aggressive strategy indicates strong long-term confidence, as the investor appears unfazed by short-term volatility. Market observers suggest this accumulation pattern could signal institutional-level conviction that Ethereum’s current prices represent a strategic buying zone.

While retail sentiment remains cautious amid heightened uncertainty, the whale’s consistent activity underscores a broader trend: large players are quietly accumulating, positioning themselves ahead of a potential recovery once macro conditions stabilize and risk appetite returns to the crypto market.

Related Reading

ETH Struggles Below $3,300 as Selling Pressure Intensifies

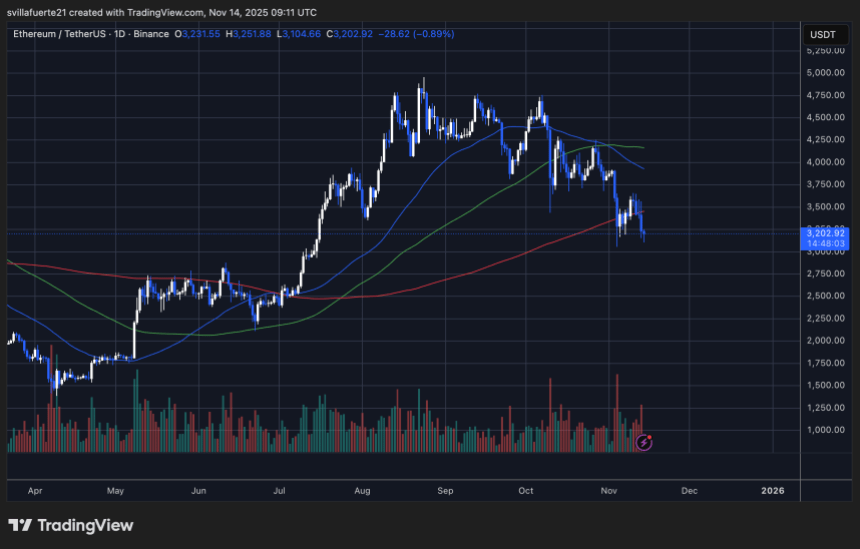

Ethereum is currently trading around $3,200, facing renewed selling pressure after briefly reclaiming the $3,400 zone earlier this week. The daily chart shows ETH struggling to hold above its 200-day moving average (red line) — a key support level that often defines long-term market structure. A decisive close below this line could confirm a deeper correction phase.

The 50-day and 100-day moving averages continue to trend downward, reinforcing the short-term bearish outlook. If Ethereum fails to recover momentum, the next major support sits near $3,000, followed by $2,850, where buyers previously stepped in during the summer consolidation. Conversely, a recovery above $3,400–$3,500 would be the first signal that bullish momentum is returning.

Related Reading

Despite the pullback, analysts emphasize that large holders — including the #66kETHBorrow whale — continue to accumulate ETH, signaling strong conviction in the asset’s long-term potential. For now, Ethereum’s trend remains fragile, and bulls must defend the $3,000 region to prevent further downside momentum.

Featured image from ChatGPT, chart from TradingView.com