The Bitcoin price has fallen by 4.7% since peaking at $71,231 yesterday, now hovering around $66,967. This decline marks a notable return of volatility in the market, driven by several critical factors.

#1 Federal Reserve’s FOMC Meeting Anticipation

The Bitcoin market seems to be in a risk-off mode ahead of tomorrow’s Federal Open Market Committee (FOMC) meeting on Wednesday, June 12th. The market’s sensitivity to macroeconomic indicators is on full display as stakeholders await the US Federal Reserve’s decision on interest rates and its economic projections.

Current expectations suggest that the Fed will maintain the interest rates at a range of 5.25%-5.50%, but the market is bracing for the updated dot plot which is projected to adopt a more hawkish stance. The adjustment anticipated involves reducing the expected rate cuts in 2024 from three to two, with some speculating about the possibility of only one cut. This hawkish tilt in monetary policy projections is poised to influence investor behavior significantly, as higher interest rates typically dampen the appeal of non-yielding assets like cryptocurrencies.

Adding to the uncertainty, the May 2024 US Consumer Price Index (CPI) data is scheduled for release just hours before the FOMC’s announcement. The market has reacted strongly to US macroeconomic data in recent months, and any deviation from expectations could lead to substantial price fluctuations.

Crypto analyst Ted commented on X, noting the critical nature of this week’s events: “After last Friday’s strong employment data, markets have almost completely priced out a July rate cut. Powell could quickly change this on Wednesday, especially if CPI comes in soft. There’s an (off) chance for significant repricing this week, which could move BTC + crypto…”

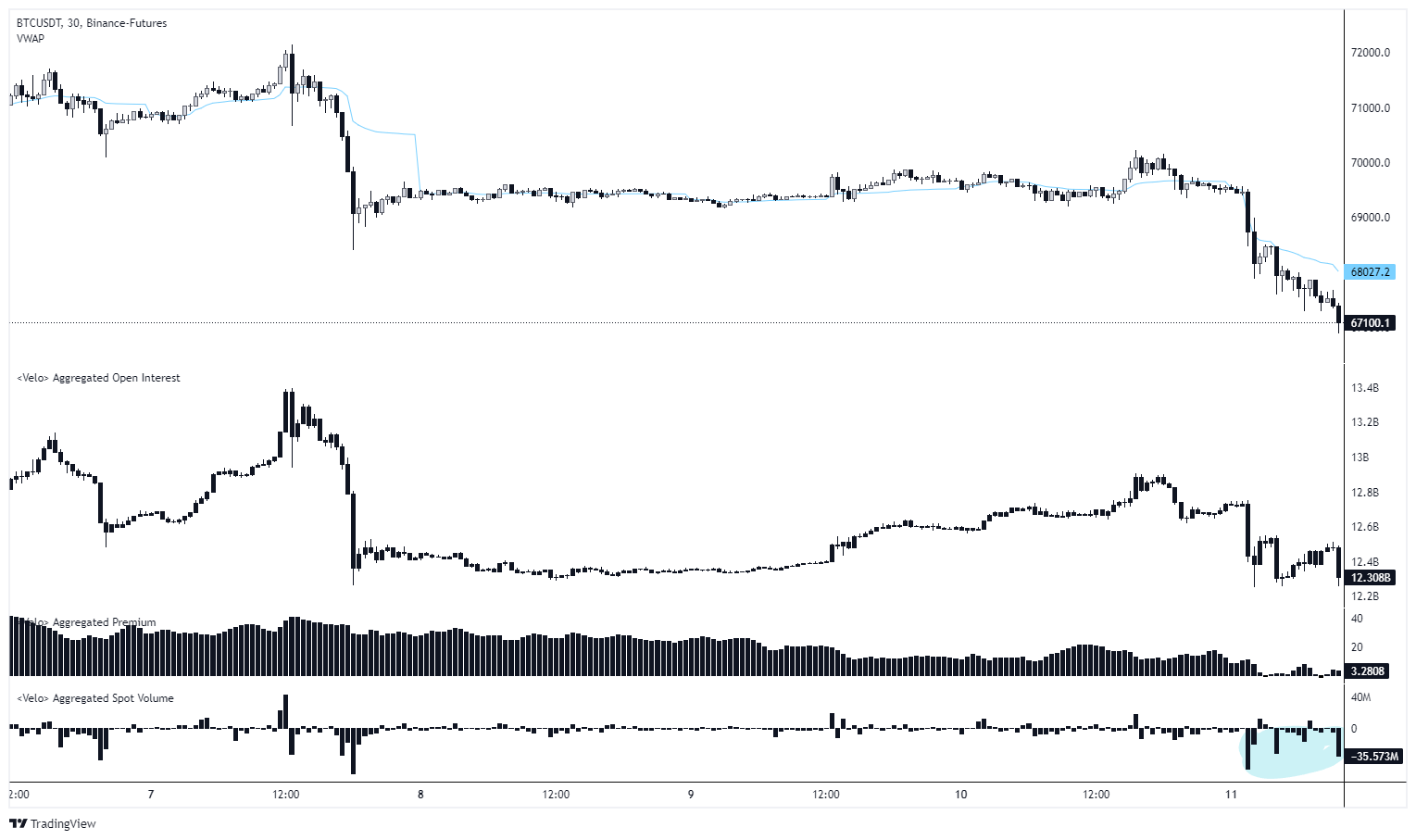

#2 Intensified Spot Selling Pressure

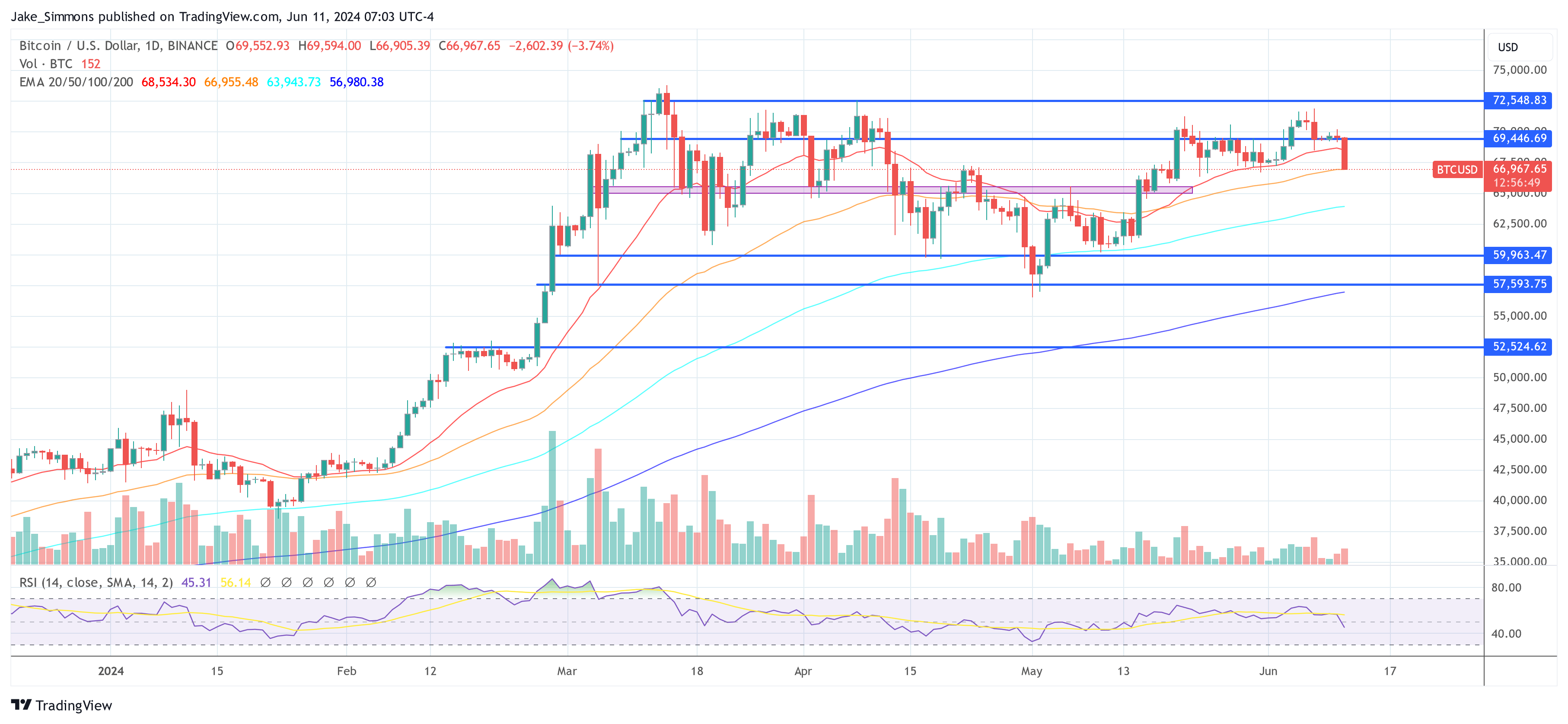

The immediate catalyst for the recent price drop appears to be a surge in spot selling. Analysis from alpha dōjō reveals that heavy selling pressure was largely responsible for the slide down to a low of $67,000. The market dynamics observed during this period indicate a clear shift, with an increased volume of sell orders not met by sufficient buy orders to sustain the price level. This imbalance has led to a breach in what was previously considered a robust support zone around $68,000.

The analysts elaborated on the situation, “Volatility has made a comeback, with BTC dropping as much as 3.5% to a low of $67k since yesterday. This selloff was primarily driven by heavy spot selling pressure, which is quite negative. A major concern is the lack of liquidations while the selloff is happening. BTC is currently in a critical area; the daily structure has been broken. BTC needs to bounce here, or it’s very likely we’ll fall back to the lower $60ks.”

#3 Inflow Streak In Spot Bitcoin ETF Inflows Ends

The investment dynamics within spot Bitcoin ETFs have also reflected the market’s bearish turn. After 19 consecutive days of positive inflows, these funds experienced significant outflows totaling $64.9 million yesterday. Notable among these was the Grayscale Bitcoin Trust, which saw outflows of $39.5 million. In contrast, BlackRock registered smaller inflows of $6.3 million.

The performance of other ETF providers showed considerable variation. Fidelity recorded outflows amounting to $3 million, while Bitwise registered inflows of $7.6 million. In contrast, Invesco experienced outflows of $20.5 million, and Valkyrie also reported outflows totaling $15.8 million.

At press time, BTC traded at $66,967.