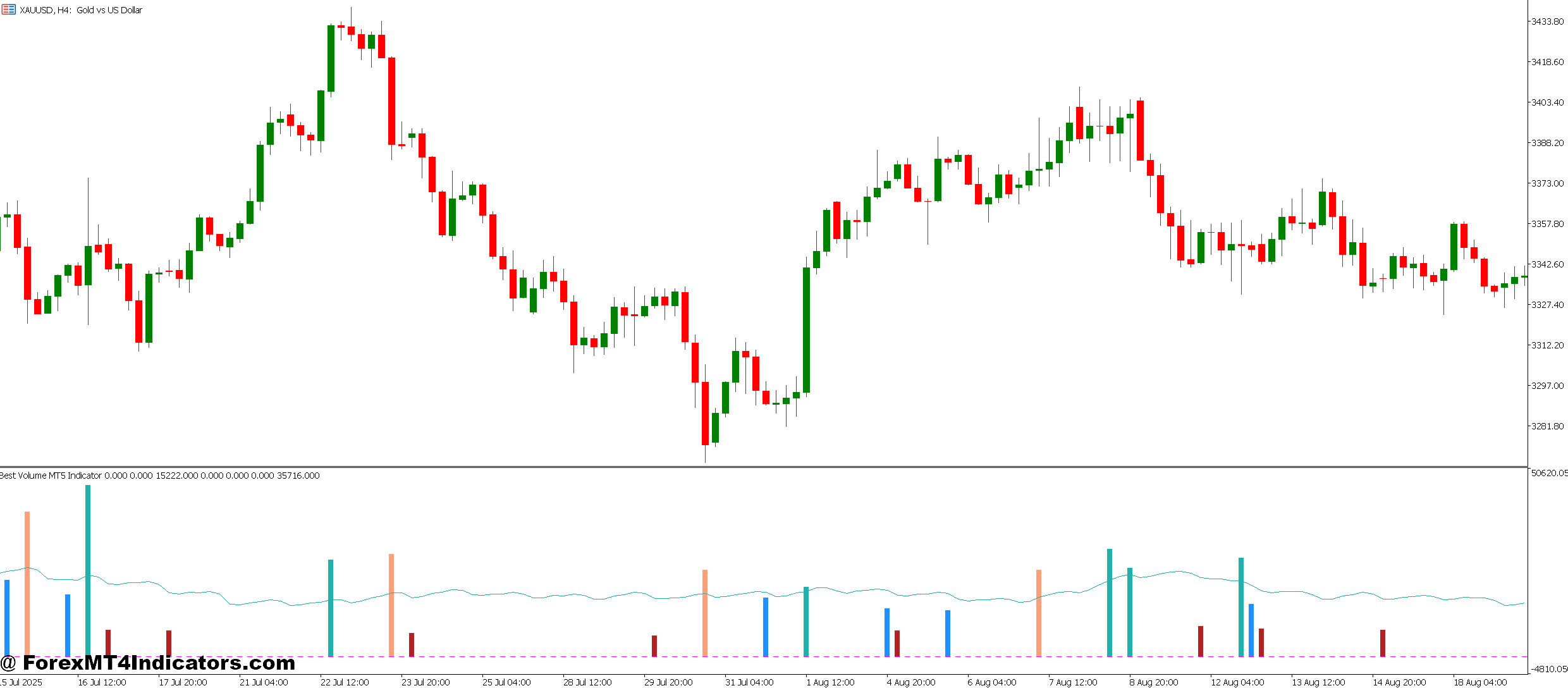

Volume indicators track how much trading activity happens during a specific time period. They show up as bars or lines on a chart, giving traders a visual representation of market participation. When volume is high, it means lots of traders are buying or selling, which usually confirms that a price move is legit. Low volume, on the other hand, suggests weak interest and warns that a trend might be running out of steam. For MT5 users, these indicators work automatically once installed, updating in real-time as the market moves throughout the day.

Why Traders Love Using Them on MT5

The MT5 platform makes volume analysis super straightforward compared to older systems. Traders can customize their volume indicators to match their trading style, whether they’re day trading or holding positions for weeks. The indicators help spot divergences—those moments when price goes up but volume drops, signaling a possible reversal. They also confirm breakouts, so traders don’t get faked out by weak price movements that reverse immediately. Plus, MT5 lets users combine volume indicators with other tools like moving averages or RSI, creating a complete picture of what’s really happening in the market.

Getting the Most Out of Volume Tools

Smart traders don’t just glance at volume bars and call it a day. They look for patterns like volume spikes during breakouts or declining volume during consolidations. When a stock or currency pair breaks through a key level with strong volume, that’s usually a green light for entry. But if the breakout happens with barely any volume, experienced traders know to stay cautious. The best approach is to test volume indicators on a demo account first, learning how they behave with different currency pairs or timeframes before risking real money.

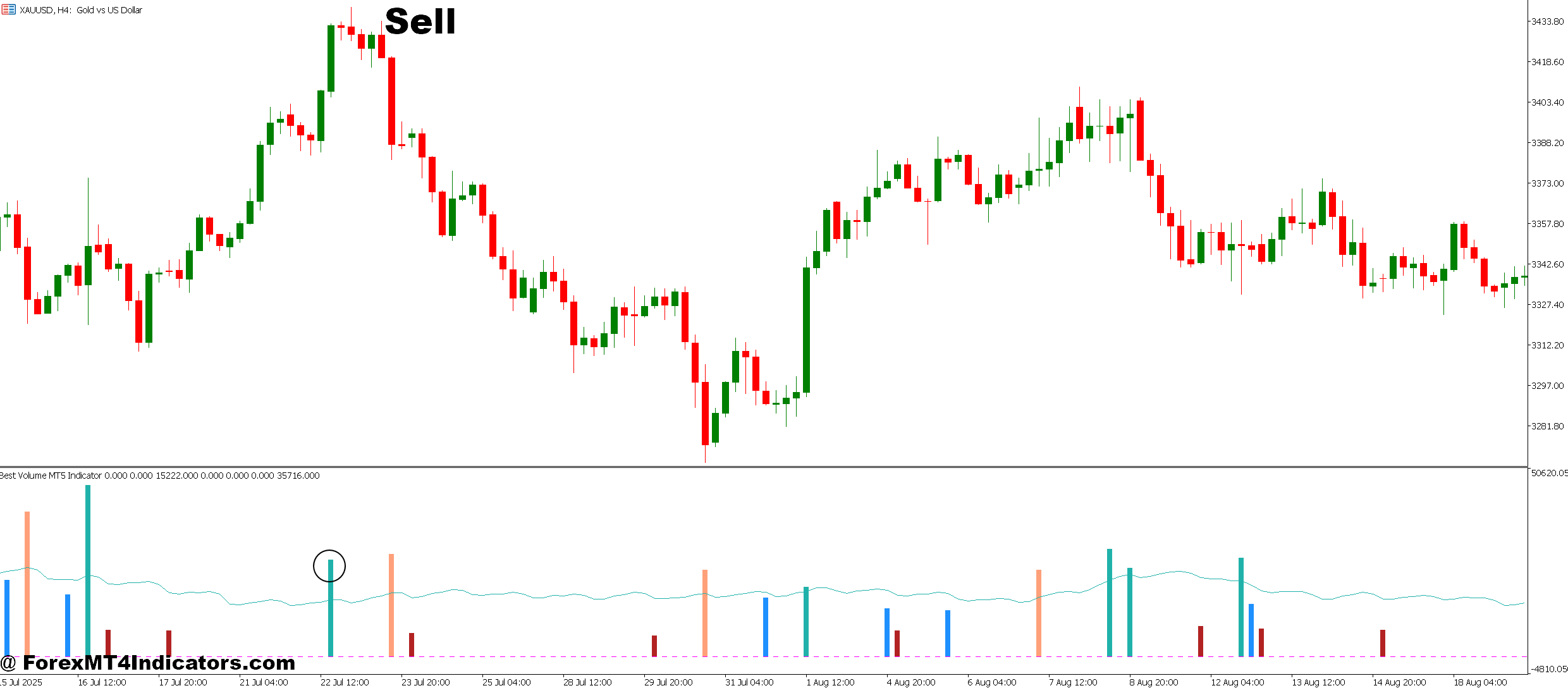

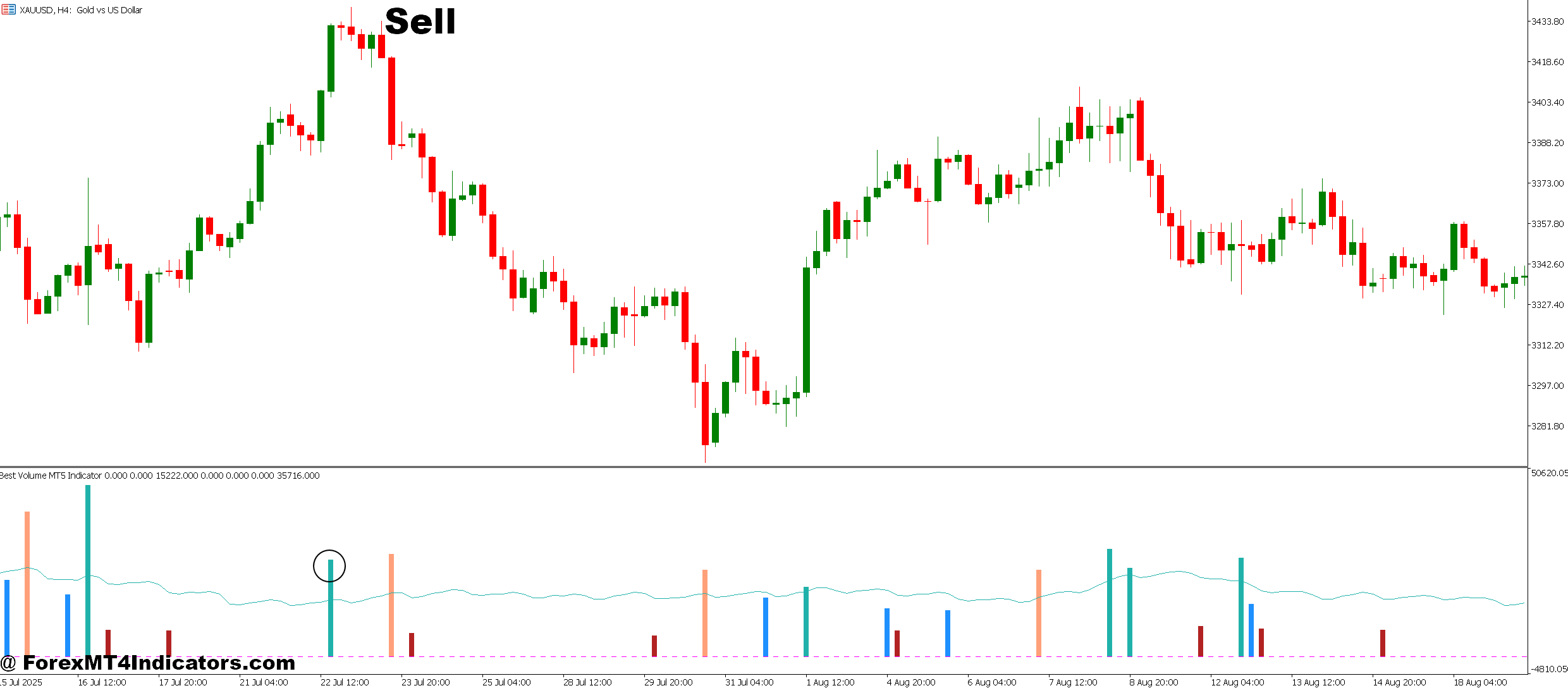

How to Trade with Best Volume MT5 Indicator

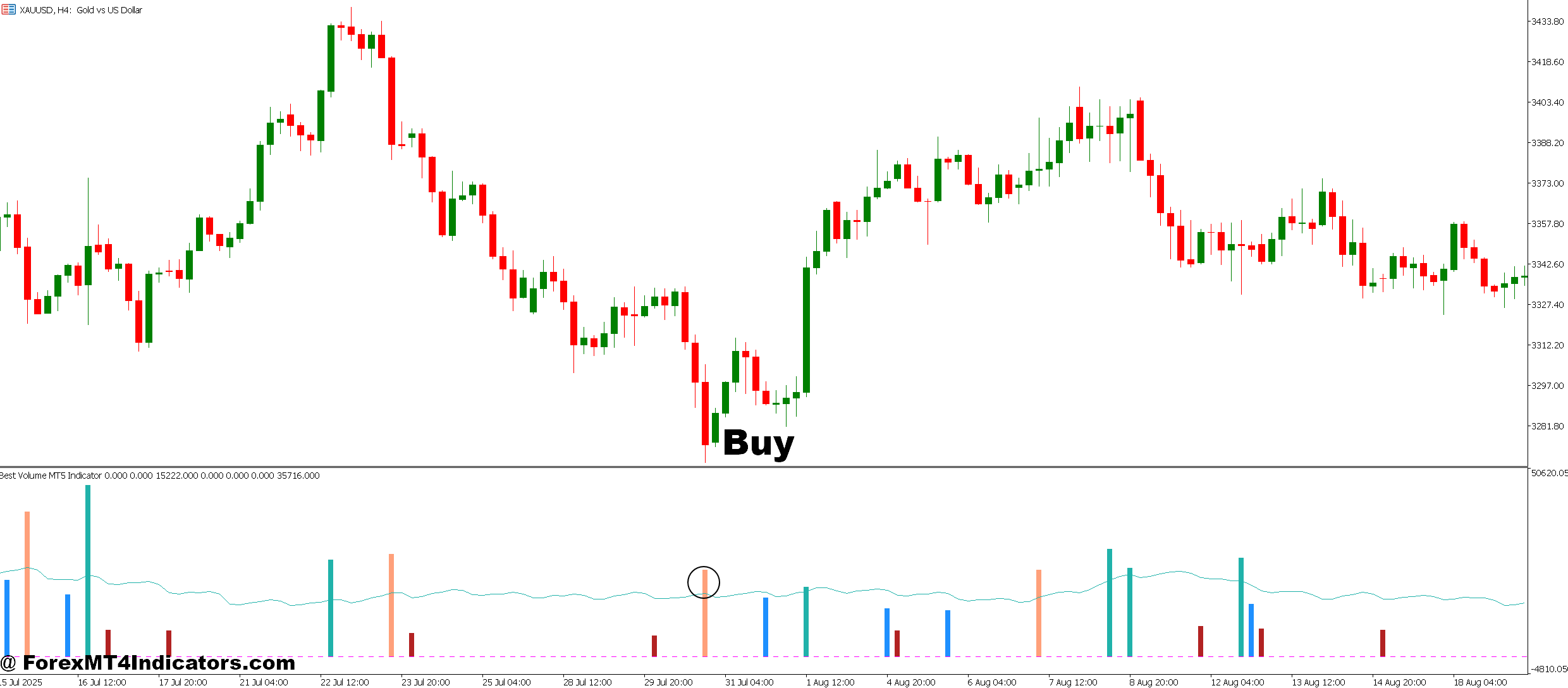

Buy Entry

- Volume Spike on Upward Breakout: When price breaks above a resistance level, and volume bars jump significantly higher than the average, it confirms strong buying. interest

- Rising Price with Rising Volume: Price makes higher highs while volume also increases, showing genuine buyer momentum behind the move.

- Volume Divergence Reversal: Price drops to a new low, but volume decreases, suggesting sellers are losing steam and a reversal upward might be coming.

- High Volume After Pullback: Price pulls back to a support level on low volume, then bounces up with a big volume spike, showing buyers stepping back in.

- Volume Confirmation at Moving Average: Price touches a key moving average (like the 50 or 200) and volume increases sharply, confirming support and potential bounce.

Sell Entry

- Volume Spike on Downward Breakout: Price breaks below a support level with a massive increase in volume, confirming strong selling pressure.

- Falling Price with Rising Volume: Price makes lower lows while volume keeps climbing, showing sellers are in full control.

- Volume Divergence at Top: Price reaches a new high, but volume drops off, warning that buyers are disappearing and a reversal down may happen soon.

- Weak Volume on Rallies: Price tries to move higher, but volume stays low, suggesting the uptrend is exhausted and vulnerable to a drop.

- High Volume Rejection: Price pushes up to a resistance level and gets rejected with a huge volume spike, showing strong sellers defending that level.

Conclusion

Best Volume indicators on MT5 give traders the insight they need to separate strong moves from weak ones. They’re not magic solutions that guarantee profits, but they definitely help traders make smarter decisions by showing where the real market interest lies. Anyone serious about improving their trading should spend time learning how volume works with price action. With practice and patience, these tools become second nature, helping traders enter trades with more confidence and exit before trends fall apart.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

>> Sign Up for XM Broker Account here with Exclusive 90% VIP Cash Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90