Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #223. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes. As always, paid subscribers will receive this week’s unabridged Market’s Compass Crypto Sweet Sixteen Study sent to their registered email Sundays*. Past publications including the Weekly ETF Studies can be accessed by paid subscribers via The Market’s Compass Substack Blog.

With apologies, due to the travel commitments of the author, today’s publication of this week’s Study was delayed.

An explanation of my objective Individual Technical Rankings and Sweet Sixteen Total Technical Ranking go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select “crypto sweet 16”. What follows is a Cliff Notes version* of the full explanation…

*The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. The TR of each individual Cryptocurrency can range from 0 to 50.

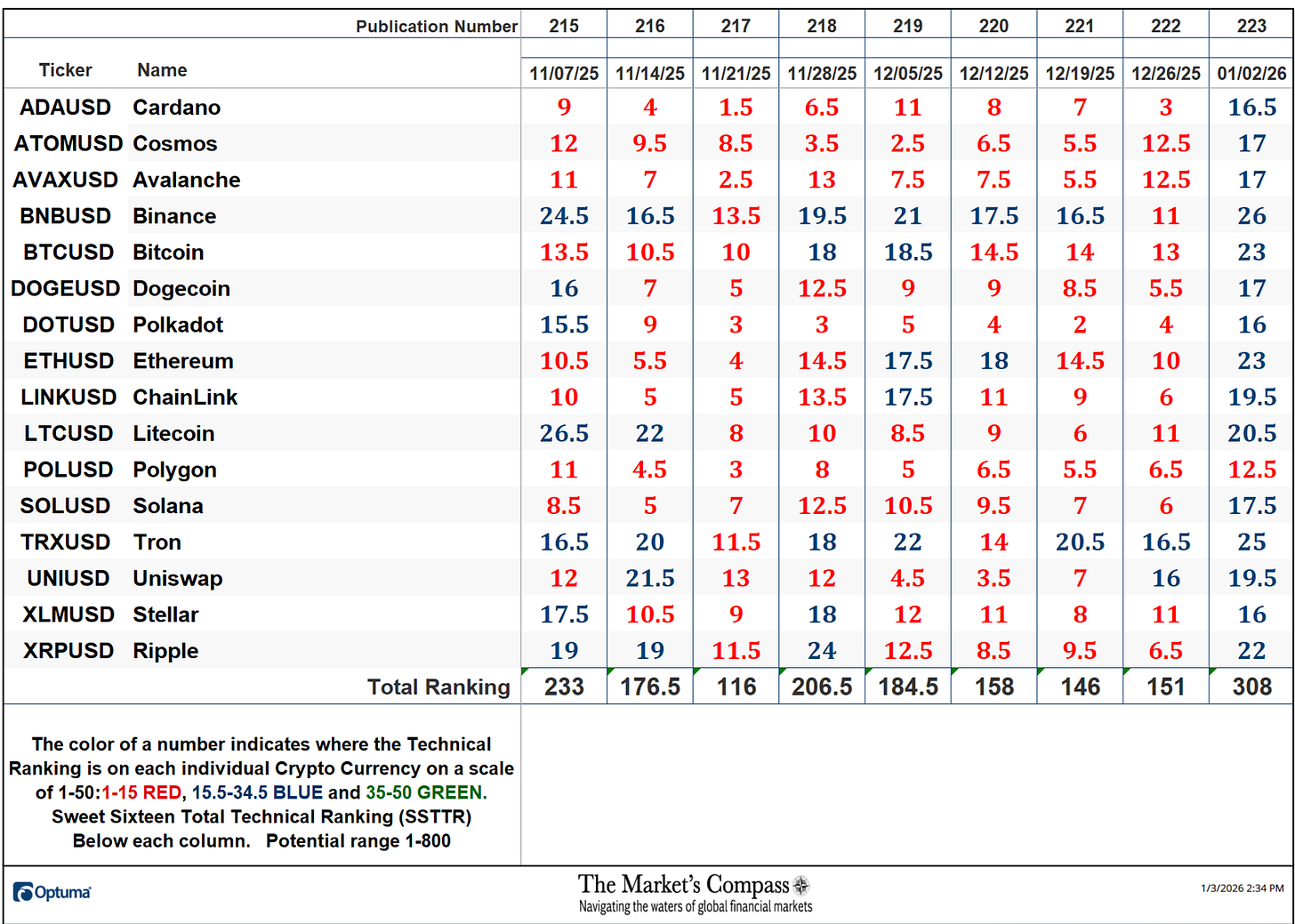

The Sweet Sixteen Total Technical Ranking rose sharply last weeklast week, up +103.97% to 308 from 151 the previous week which was up +3.42% from 146 the week before that.

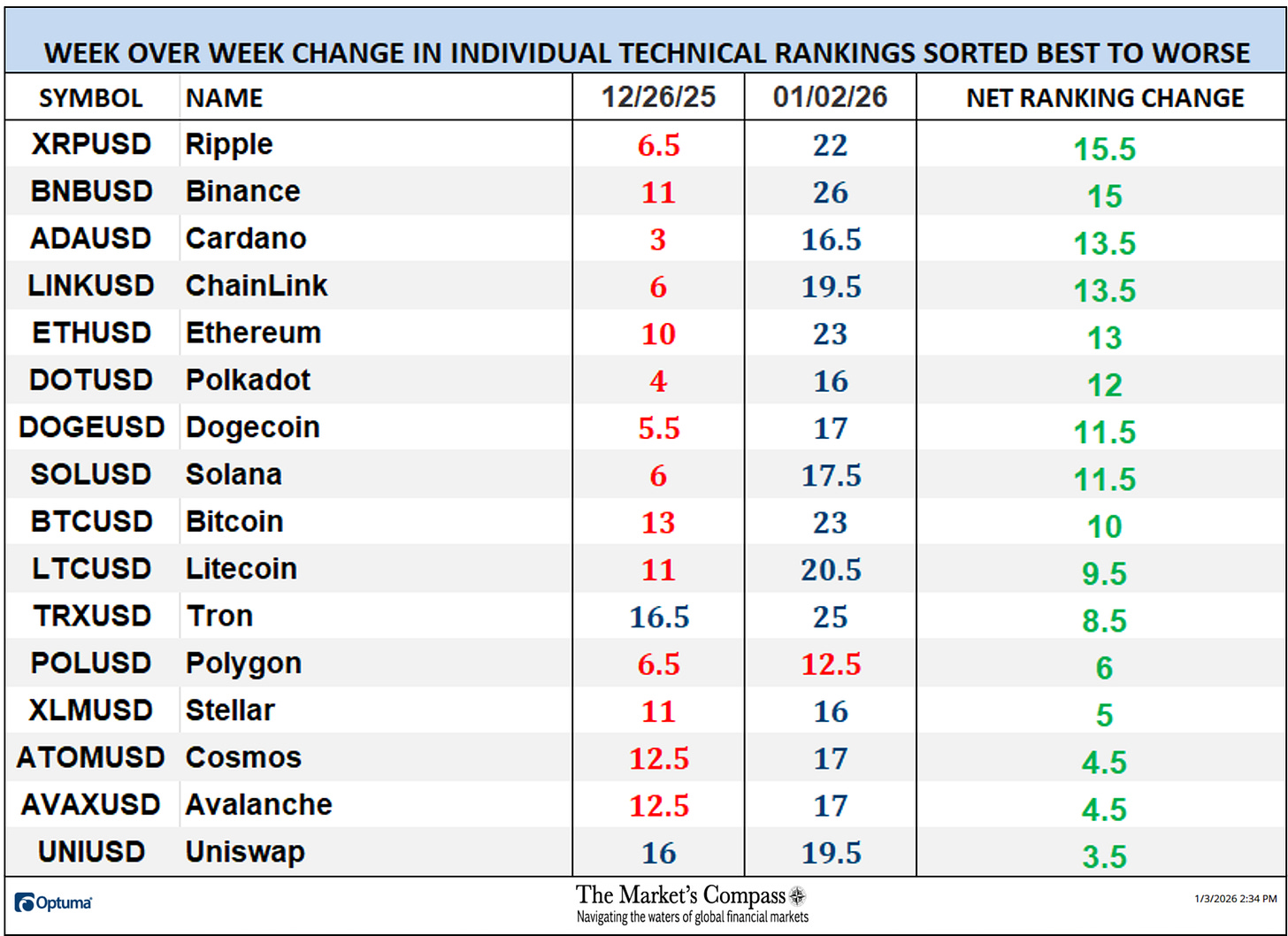

All the Sweet Sixteen made gains in their TRs last week vs. the previous week when seven marked gains in their TRs, and nine moved lower. The average Sweet Sixteen TR gain was +9.81, vs. the average TR gain of +0.31 the previous week. Once again for the twelfth week in a row there were zero TRs in the green zone last week. That said, thirteen of the Sweet Sixteen TRs end up rising into the “blue zone” (TRs between 15.5 and 34.5) from the “red zone” (TRs between 0 and 15) in a very impressive confirmation of the broader market rally with Uniswap (UNI) and Tron (TRX) holding their ground in the “blue zone”. The previous week two were in the “blue zone” (TRs between 15.5 and 34.5) and fourteen were in the “red zone” (TRs between 0 and 15).

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

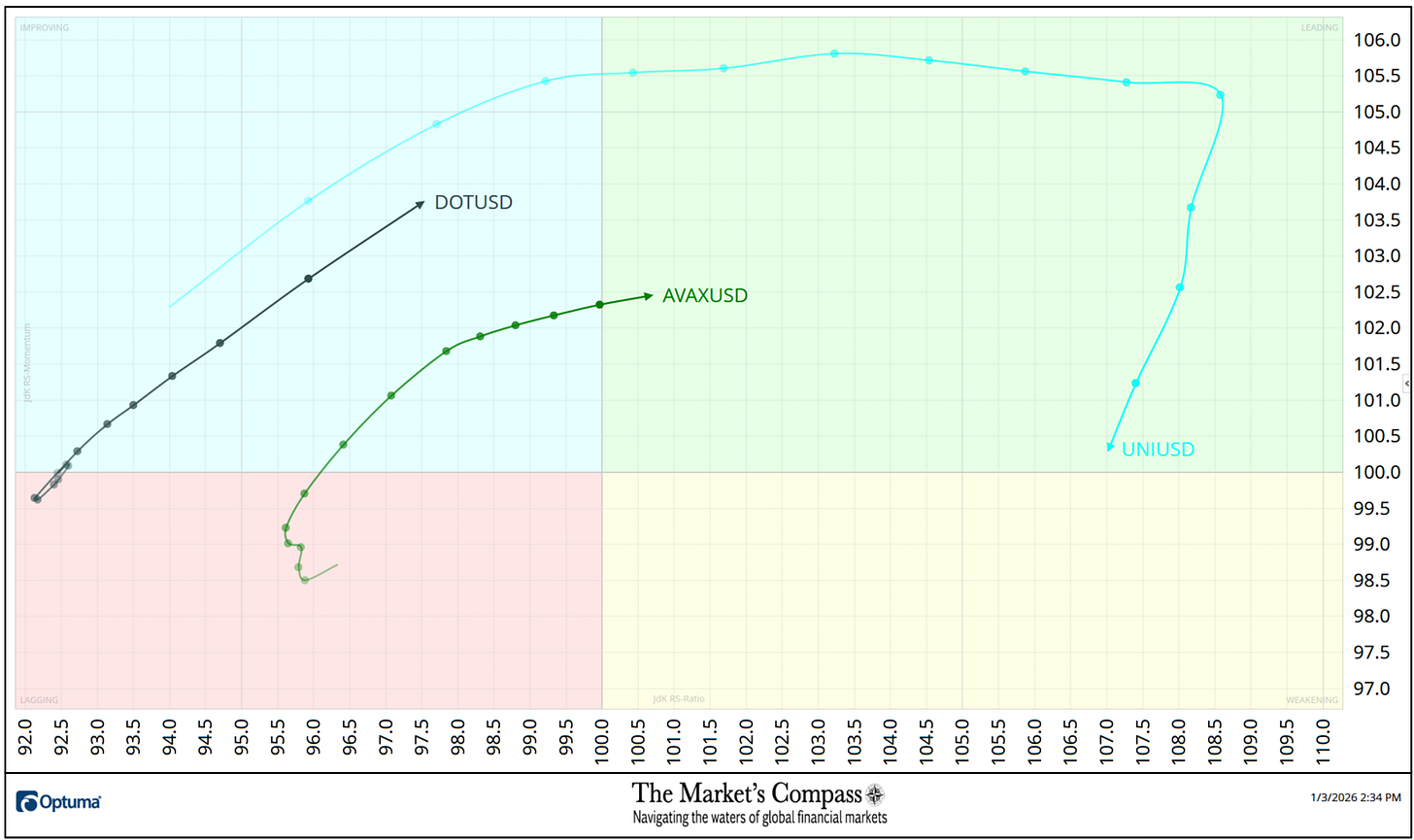

The chart below has two weeks, or 14 days, of relative data points vs. the benchmark, (the CCi30 Index) at the center, deliniated by the dots or nodes. Not all of the Sweet Sixteen are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

Uniswap (UNI) has been and is noteworthy as will be seen not only here but in the “Tabulation Table” below. UNI went on to new Relative Strength high on Monday of last week (a ratio to the benchmark of the CCi30 Index of 108.6) until Relative Strength Momentum began to “melt away” as it rolled over in the Leading Quadrant leaving it only one day of contracting Relative Strength Momentum from entering the Weakening Quadrant. That said it still holds the “pole position” of the best Relative Strength vs the Index at 107 as of last Friday. Avalanche (AVAX) has made a three Quadrant move, rising out of the Lagging Quadrant, driving through the Improving Quadrant last week to close Friday in the Leading Quadrant. Polkadot (DOT) has escaped the Laging Quadrant after a quick turnaround in the Lagging Quadrant and exhibited positive Relative Strength Momentum at the end of last week (note the distance between the daily nodes) as it rises in the Improving Quadrant.

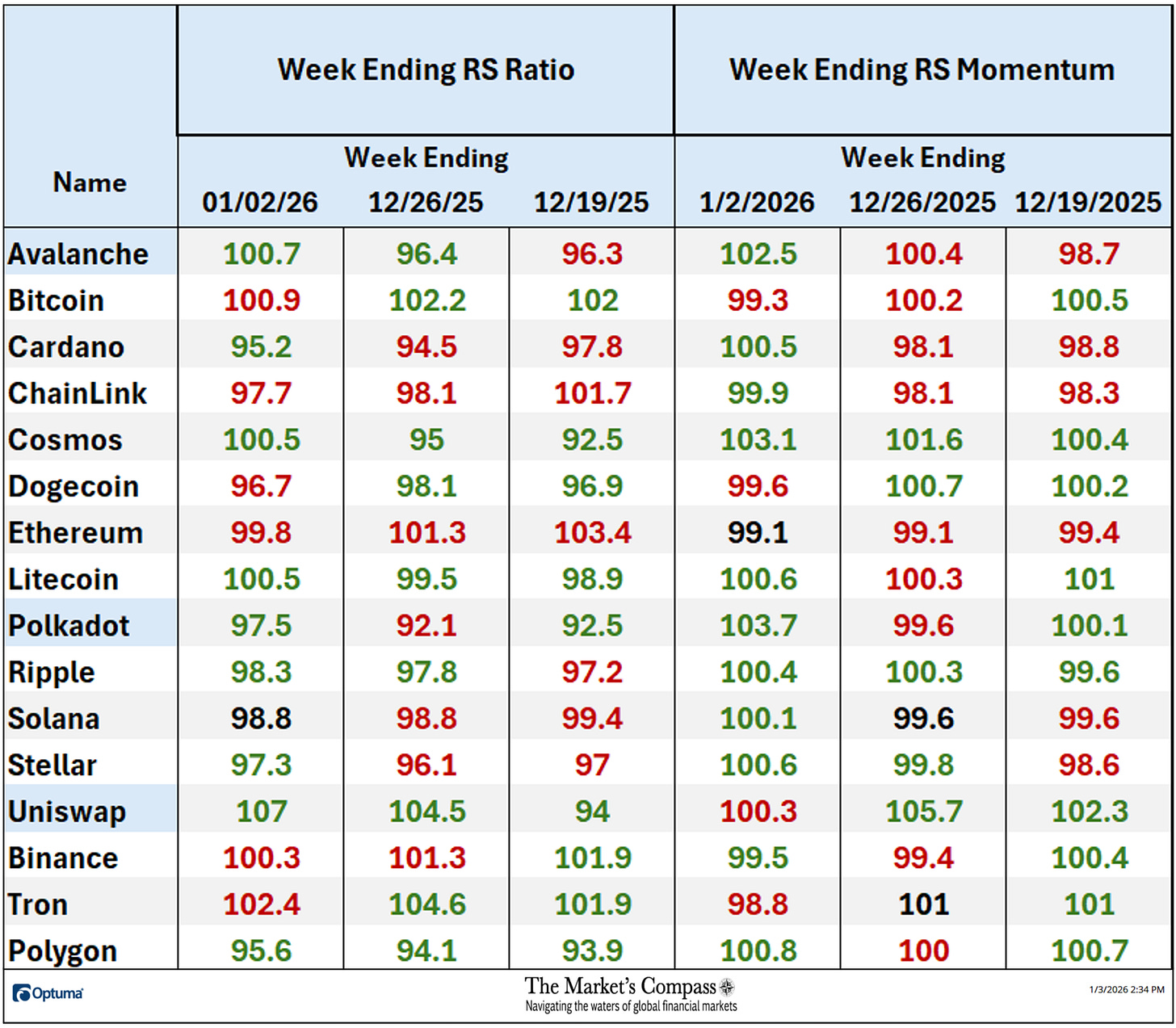

The “Tabulation Table” below marks the Relative Strength and Relative Strength Momentum readings of the Sweet Sixteen vs. the CCi30 Index at the end of last week and the two preceding weeks. If there has been an improvement in either the Relative Strength Ratio or the Relative Strength Momentum reading since the preceding week, I have highlighted it in green. If there has been a contraction in both it is highlighted in red and an unchanged reading in either will remain black. The color-coding system has served as a heat map over the past three weeks highlighting either the continued improvement, deterioration, or stasis vs. the benchmark CCi30 Index. The crypto currencies that are in the comments below the RRG chart are highlighted in blue.

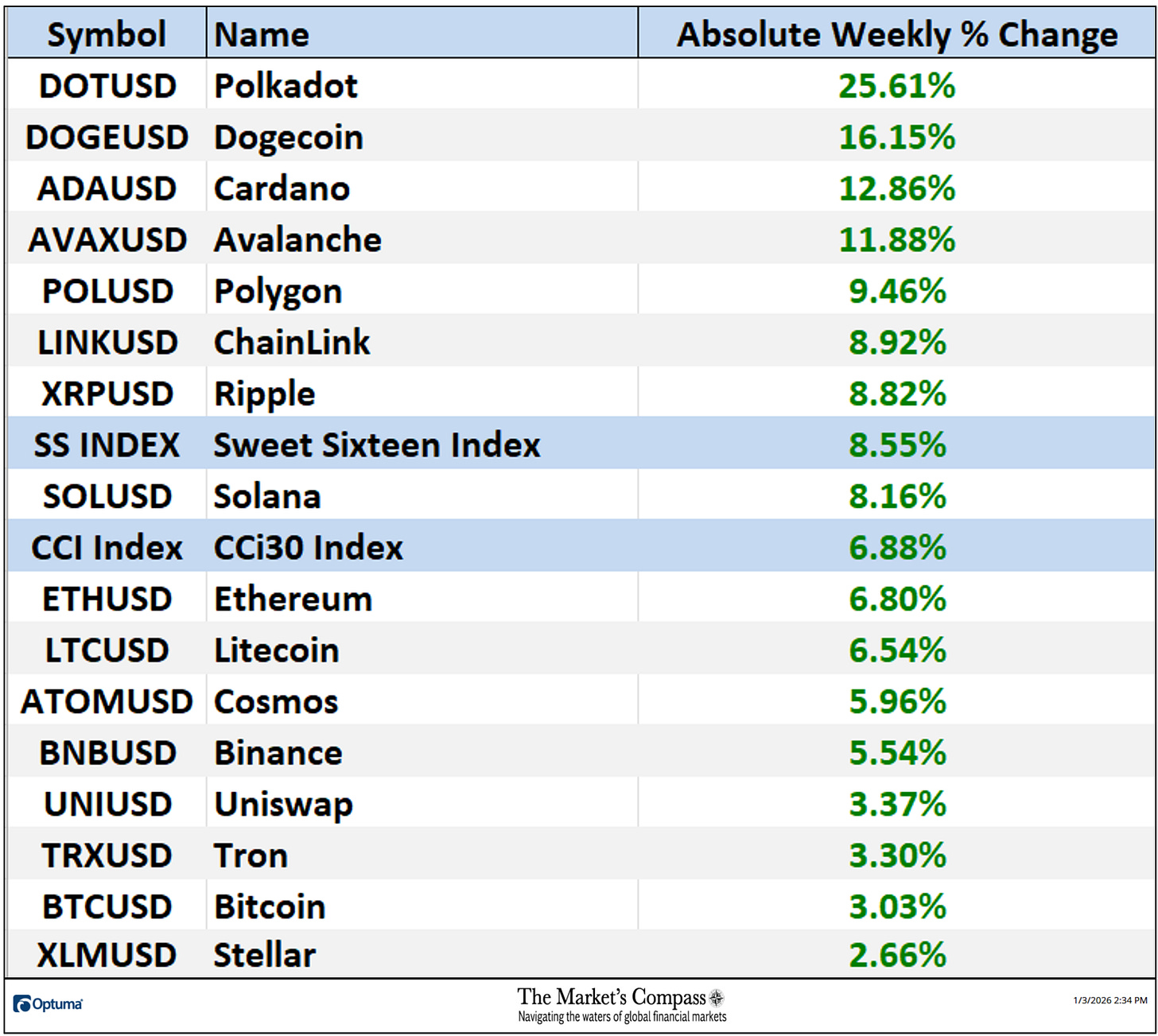

*Friday December 26th to Friday January 2nd.

All Sweet Sixteen gained ground over the past seven days, four of which marked double-digit absolute price gains. Of those four, Polkadot (DOT) led the pack, up +25.61% adding to its +9.74% gain the week before (daily chart posted below). The week before only three gained absolute ground and thirteen lost absolute ground. Last week the average absolute percentage gain was +9.81% vs. the week before when the average absolute gain was +0.31%. Both weekly average moves exclude the two Indexes.

Although not posted on the chart Polkadot closed the week at 2.1643.

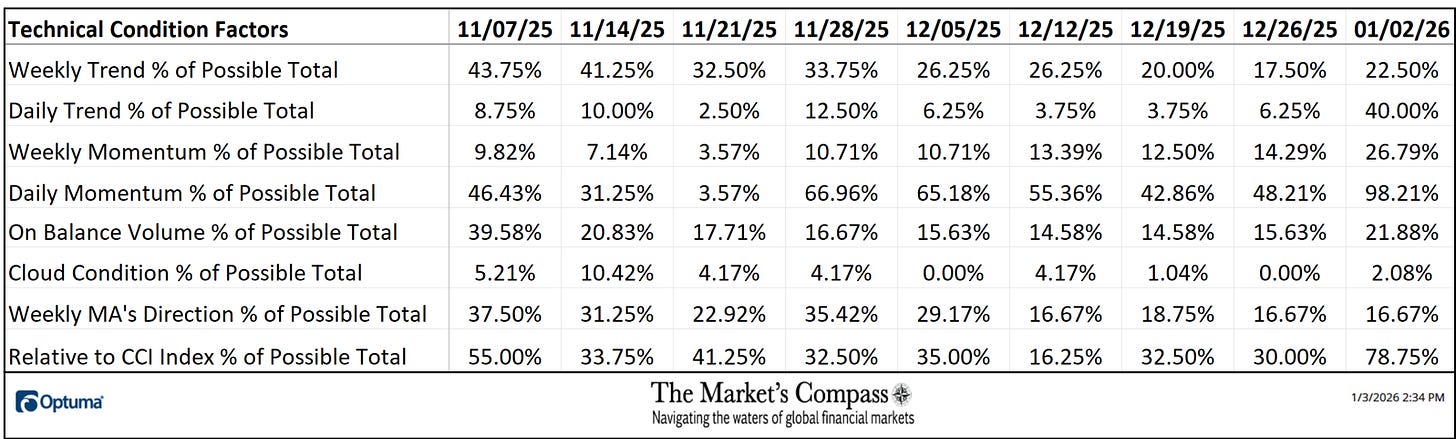

The Technical Condition Factors or TCFs are utilized in the calculation of the Individual Crypto Currencies Technical Rankings. What is shown in the excel panel below is the total TCFs of all sixteen TRs. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 16 Cryptocurrencies. Because of that, the excel sheet below calculates each factor’s weekly reading as a percentage of the possible total.

A full explanation of my Technical Condition Factors go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

The Daily Momentum Technical Condition Factor or “DMTCF” rose to 98.21% or 110 out of a possible 112 (marking an overbought condition in Daily Momentum for the first time since September) from 48.21% or 54 at the end of previous week when it rose after four weeks of declines.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week seven of the TCFs rose and one was unchanged, confirming the broad-based rally in the Crypto markets.

*The “TSSTCF” Oscillator tallies the eight objective Technical Condition Factors into one overbought / oversold indicator that ranges between 0 and 8.

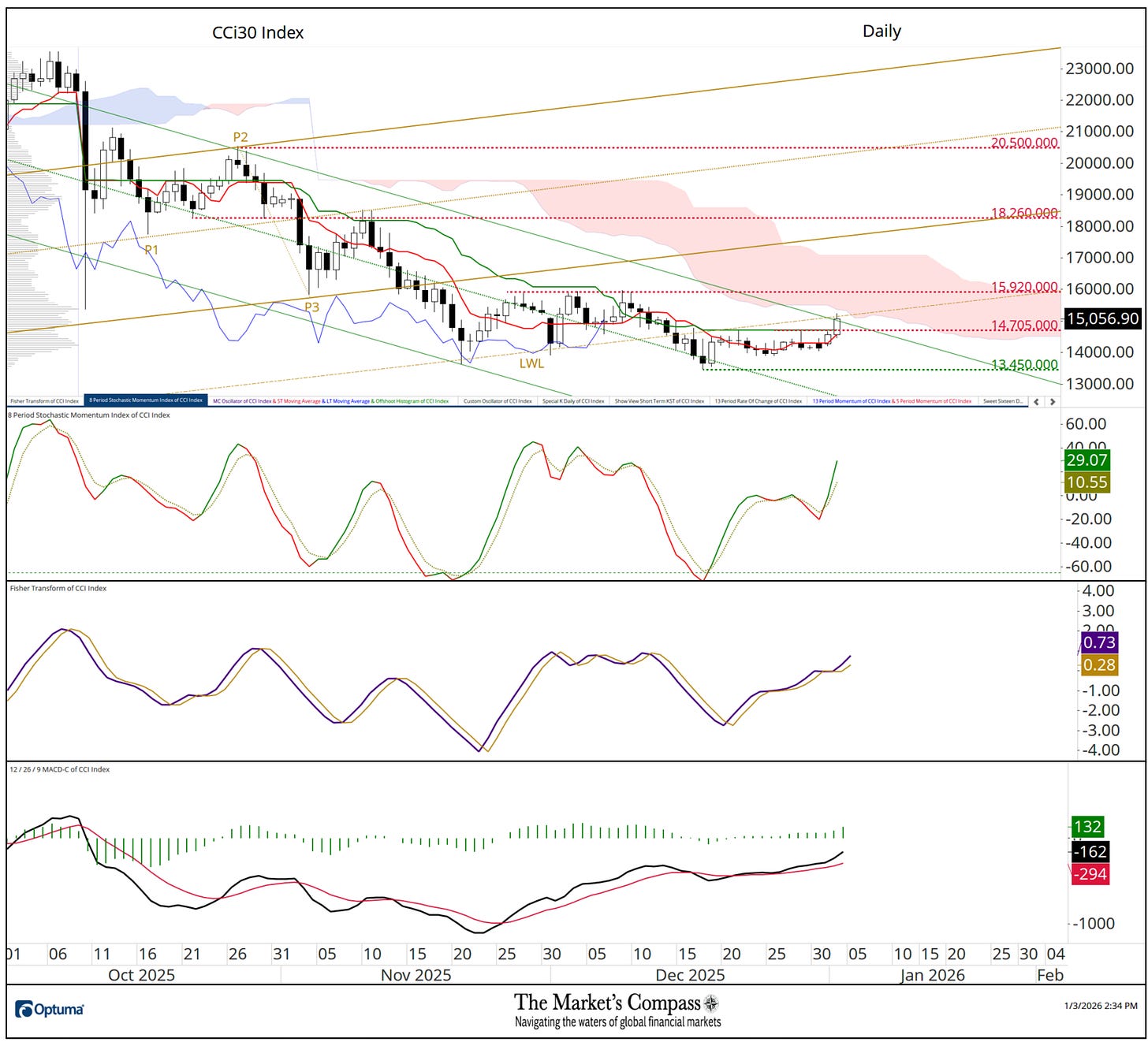

At the end of last week, the CCi30 Index, which had rallied +6.88% over the previous seven days, was challenging first resistance at the 15,265.00 level (at the time of publication the Index was above that level). The Total Technical Condition Factor has escaped oversold territory where it was trapped under the shorter-term 5-Week Moving Average (red line) which until the end of last week had been in a steady down trend since late August. A follow through to last week’s turn in price and advance through the Tenkan Plot (solid red line) which is at 16,241, would suggest that the downtrend in weekly prices has reversed and at the very least a measurable countertrend rally has begun.

The Daily chart of the CCi30 Index gives the long-suffering Crypto bulls a ray of hope that the downtrend in prices may have run its course (at least temporarily). For two weeks the Index had been trapped in a sideways trading range until Friday’s breakout and close above the 14,705 level. With that, the Index closed the week right on the Upper Parallel (solid green line) of the longer-term Standard Pitchfork (green P1-P3) and just below the Lower Warning Line (gold LWL) of the shorter-term Standard Pitchfork (gold P1 through P3). Those two Pitchfork features, plus the bottom of the Cloud will be a cluster of key resistance but as both the Stochastic Momentum Index and MACD suggest there is a turn in price momentum that indicates that if that level is overtaken the resistance at 15,920 could be challenged.

The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…

www.optuma.com/TMC.

An in-depth comprehensive lesson on Pitchforks and analysis as well as a basic tutorial on the Tools of Technical Analysis is available on my website…

www.themarketscompass.com