10 Nov Bitfinex Alpha | Market Consolidating, not Cascading

in Bitfinex Alpha

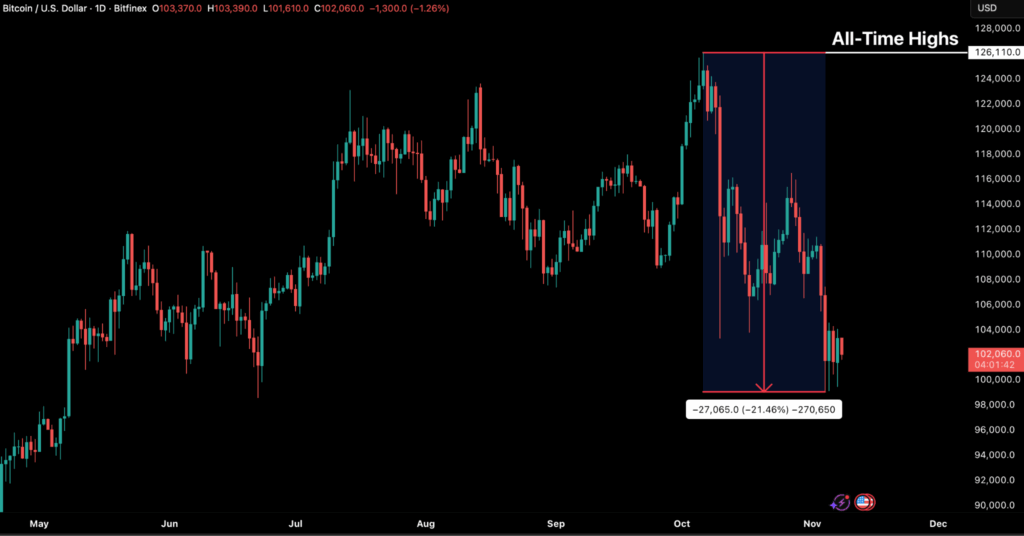

Bitcoin was down by as much as 21.46 percent from its October all-time high last week, briefly dipping below the psychological $100,000 mark to a low of $99,045. Such a fall likely signifies the establishment of a new consolidation base rather than the onset of a cascading sell-off. Historical market and on-chain data suggest that the current price action closely mirrors prior mid-cycle corrections, where structural participants stabilise exposure and capital rotates within the ecosystem before broader uptrend continuation. The failure to hold above the short-term holders’ (STH) cost basis of $112,500 has led to a controlled decline, bringing BTC back below that key level and confirming the anticipated retest of deeper structural supports.

At these levels, roughly 72 percent of BTC supply remains in profit, near the lower end of the 70–90 percent equilibrium band typical of mid-cycle slowdowns. This condition indicates that while selling pressure persists, much of the speculative excess has already been flushed out. The $88,500 Active Investors’ Realised Price now stands as the next major downside reference, aligning with past cycle support zones where capitulation historically transitioned into re-accumulation. While brief relief rallies toward the STH cost basis remain likely, a sustained recovery will depend on renewed demand inflows from institutional and retail participants. Until then, the market is expected to remain range-bound as volatility compresses and structural positioning resets ahead of the next major cycle move.

The US economy is flashing mixed signals where corporate borrowing is bouncing back, but hiring is faltering. In the absence of official data, new private-sector data show that the US labour market is weakening faster than expected, with October’s ADP National Employment Report recording just 42,000 new jobs, almost all from large firms, while small and mid-sized companies shed workers for the third consecutive month. Consumer confidence has also fallen 6 percent in November, signalling that households are starting to feel the strain of slower hiring and policy uncertainty.

The crypto industry is entering a new phase of mainstream adoption, driven by record growth in stablecoins and rising regulatory engagement worldwide. In October 2025, Ethereum-based stablecoins hit an all-time high of $2.82 trillion in monthly volume, up 45 percent from September, as investors rotated into dollar-pegged tokens amid market pullbacks and Ethereum’s expanding Layer-2 ecosystem enabled faster, cheaper transactions. The milestone cements Ethereum’s role as a foundation of digital finance, powering remittances, DeFi, and institutional settlements.

Regulators are also accelerating efforts to integrate blockchain into traditional finance. In Japan, the Financial Services Agency approved a stablecoin pilot involving megabanks Mizuho, MUFG, and SMBC, set to begin in November 2025, to test regulated digital payments under new financial laws. Meanwhile, in Australia, the Chair of the Australian Securities & Investment Commission (ASIC) Joe Longo urged the nation to embrace tokenisation to modernise its markets, announcing a relaunch of the ASIC Innovation Hub and updated licensing for stablecoins and tokenised securities.